The Ultimate Guide to Loan Prepayment: Slash Your Tenure & Save Lakhs in Interest

Is your home loan interest eating up your hard-earned money? Learn why prepaying your loan is the smartest financial move you can make in 2026.

If you have a home loan or a long-term personal loan, you are likely paying more interest to the bank than the principal amount you borrowed. This is the harsh reality of long-tenure loans. However, there is a powerful tool at your disposal to reverse this equation: Loan Prepayment.

Try the Home Loan Prepayment Calculator to see how much you can save by prepaying your loan.

What is Loan Prepayment?

Loan Prepayment (or part-payment) is the act of paying off a portion of your outstanding principal amount over and above your regular EMI.

When you make a prepayment, the amount goes directly towards reducing your Principal Outstanding. Since interest is calculated on the remaining principal, a lower principal means a lower interest burden for the rest of the loan tenure.

- • Part-Payment: Paying a lump sum (e.g., ₹50,000) while continuing the loan.

- • Foreclosure: Paying the entire outstanding amount to close the loan account permanently.

The Golden Dilemma: Reduce Tenure or Reduce EMI?

When you make a part-payment, banks usually give you two options:

- Reduce the EMI: Keep the tenure the same, but pay less every month.

- Reduce the Tenure: Keep the EMI the same, but finish the loan earlier.

Winner: Reducing the Tenure

Mathematically, reducing the tenure saves you significantly more money than reducing the EMI.

The Logic: When you reduce the tenure, you stop paying interest for those specific years entirely. When you reduce the EMI, you drag the loan out for the full term, allowing the bank to keep charging interest on the balance for longer.

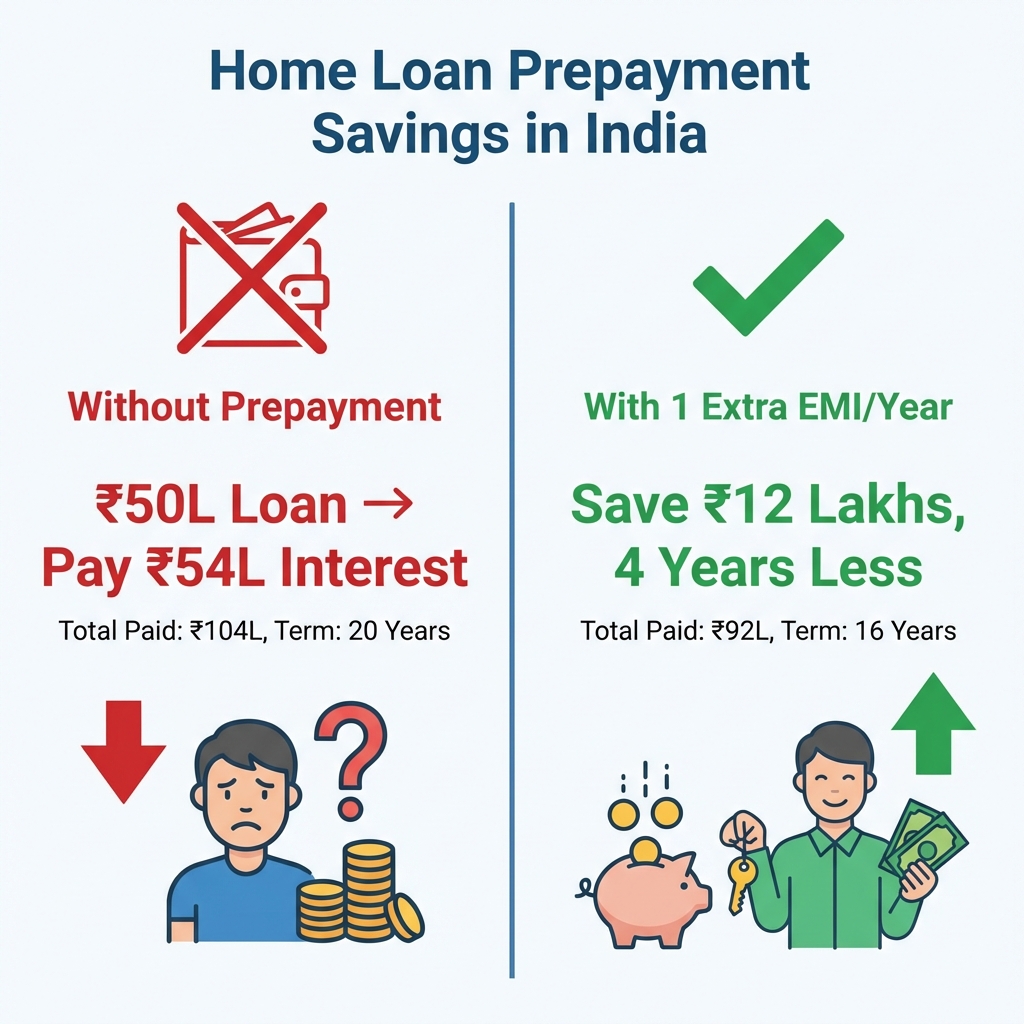

The Math: How a Small Prepayment Saves Big

Scenario:

- • Loan Amount: ₹50 Lakhs

- • Interest Rate: 8.50%

- • Tenure: 20 Years

- • EMI: ₹43,391

Total Interest You Will Pay: ₹54.13 Lakhs (More than the loan amount itself!)

Strategy: The "1 Extra EMI" Rule

If you prepay just one extra EMI per year (approx ₹43,000) towards the principal:

- • Tenure Reduces by: ~4 Years

- • Interest Saved: ~₹12 Lakhs

By paying just ₹8.6 Lakhs extra (over 20 years), you save ₹12 Lakhs in interest. This is a guaranteed return on investment of over 14%.

→ Calculate your exact savings with our Prepayment Calculator

RBI Guidelines on Prepayment Charges (2025-2026)

Many borrowers fear penalties. Here is the official stance from the Reserve Bank of India (RBI) regarding Home Loans:

| Loan Type | Interest Type | Borrower Type | Prepayment Penalty |

|---|---|---|---|

| Home Loan | Floating Rate | Individual | ZERO (Nil) |

| Home Loan | Fixed Rate | Individual | Usually 2-3% |

| Personal Loan | Fixed/Floating | Individual | Varies (Check Agreement) |

Note: If you have a floating rate home loan (which most RLLR loans are), banks cannot charge you a penalty for part-payment or foreclosure.

When is the Best Time to Prepay?

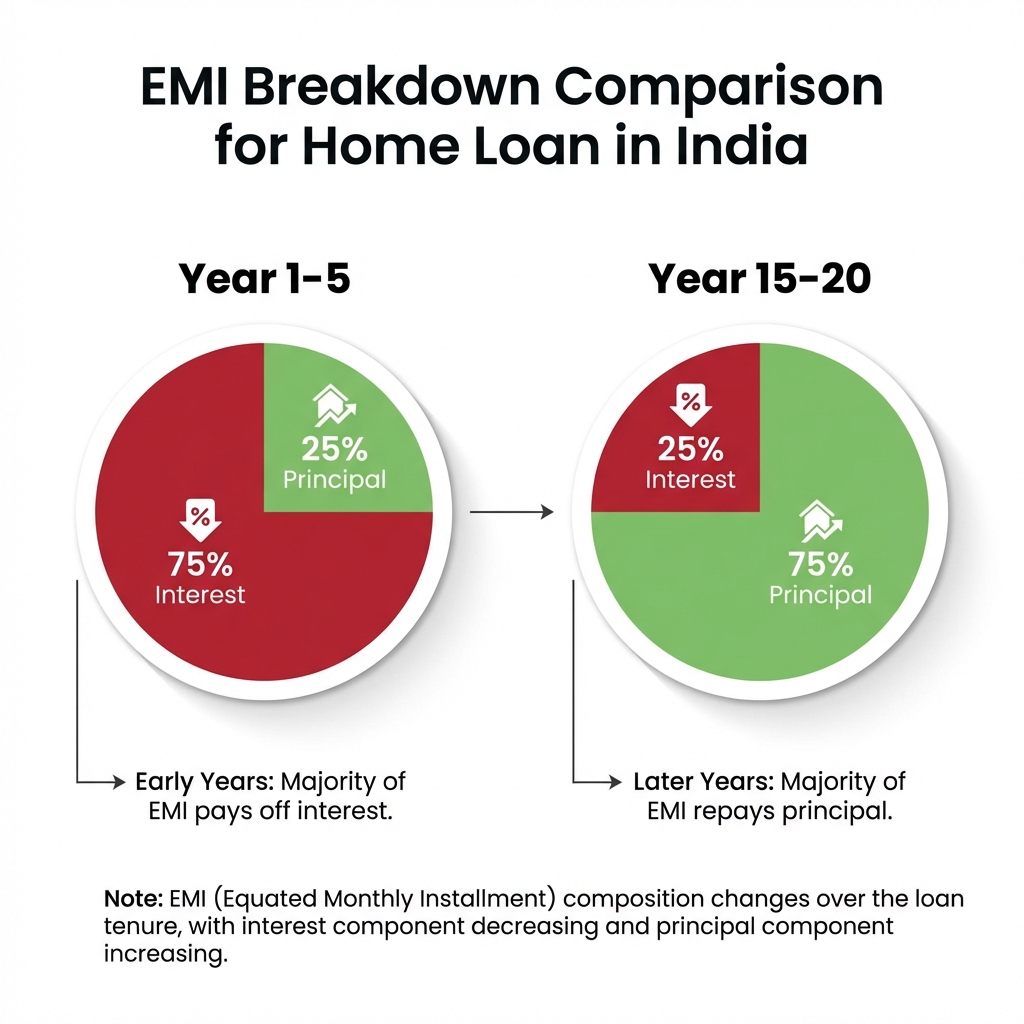

The timing of your prepayment matters. Loans in India follow an Amortization Schedule where the initial years are interest-heavy.

- • Year 1-5: ~70-80% of your EMI goes towards Interest; only 20-30% pays off Principal.

- • Year 15-20: Most of your EMI pays off Principal.

Strategy

Prepaying is most effective in the first 5-7 years of the loan. Prepaying in the 18th year of a 20-year loan offers negligible benefits because you have already paid most of the interest.

Tax Implications: The Section 80C Trade-off

Before you rush to prepay, consider the tax angle.

- • Section 24(b): Allows deduction up to ₹2 Lakhs on Interest paid.

- • Section 80C: Allows deduction up to ₹1.5 Lakhs on Principal repayment.

The Catch: If you prepay aggressively, your interest component might drop below ₹2 Lakhs per year, reducing your tax deduction.

The Verdict: Do not hold onto a loan just to save tax. The interest you pay to the bank (e.g., 8.5%) is always higher than the tax you save (e.g., 30% of that amount). It is almost always better to pay off the debt.

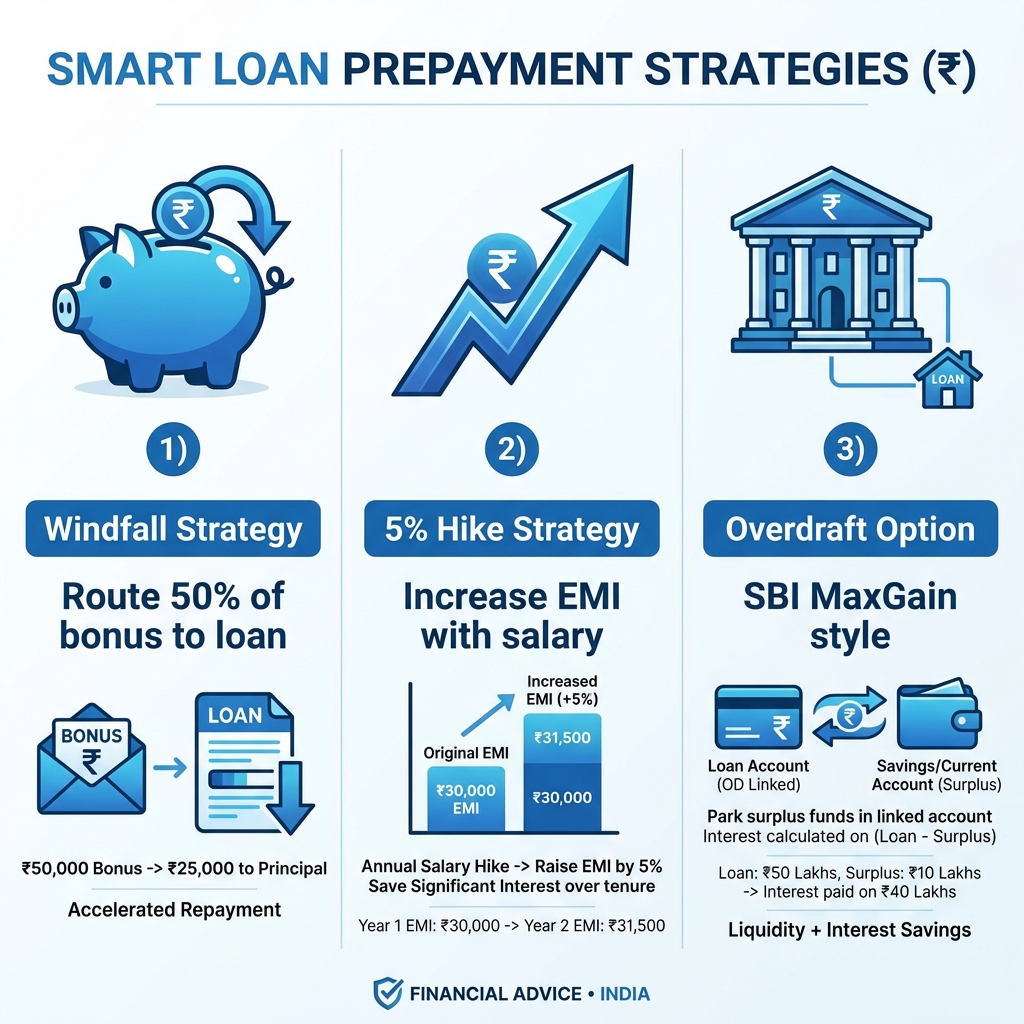

3 Smart Strategies for Debt-Free Living

1. The "Windfall" Strategy

Whenever you get a bonus, tax refund, or maturity from an FD, route 50% of it immediately to your home loan principal.

2. The 5% Hike Strategy

Every time your salary increases, increase your EMI by 5%. This small change can slash a 20-year loan to roughly 12 years.

3. The Overdraft (Smart Home Loan) Option

If you have surplus cash but might need it later, opt for a "Home Loan Overdraft" (e.g., SBI MaxGain). You park money in the loan account to save interest, but you can withdraw it if an emergency strikes.

Frequently Asked Questions (FAQs)

Q1: Can I make a part-payment online?

Yes, most top banks (HDFC, SBI, ICICI) allow you to make part-payments directly via their mobile banking apps or net banking portals. You do not need to visit the branch.

Q2: Is there a minimum amount for part-payment?

Some banks require a minimum of one EMI amount or ₹10,000 to accept a part-payment online. Check your loan dashboard for specifics.

Q3: Should I invest in SIP or prepay my loan?

If your loan interest is 8.5% and you can earn 12% in Mutual Funds, math says "Invest." However, psychology says "Prepay." Being debt-free offers peace of mind that a spreadsheet cannot calculate. A balanced approach is to do both.

Q4: Does prepayment affect my CIBIL score?

Positively! Reducing your debt burden ratio improves your creditworthiness. Closing a loan successfully is a green flag for future lenders.

Ready to save Lakhs?

Login to your loan account today and check the "Part Payment" option. Even a small start of ₹10,000 can shave months off your tenure!

Calculate Your Savings Now →